Before

The Ohio House of Representatives

Select Committee on Energy Policy and Oversight

Testimony On

House Bill 738 and House Bill 746

By

Jeff Jacobson, Strategic Insight Group

On Behalf of the Office of the Ohio Consumers’ Counsel

September 23, 2020

Hello Chair Hoops, Vice-Chair Abrams, Ranking Member Leland and members of the House Select Committee on Energy Policy and Oversight. I hope you and your colleagues are well. Consumers’ Counsel Weston and I thank you – and the sponsors and co-sponsors of House Bills 738 and 746 – for this opportunity to testify as a proponent of these bills. Last year we testified seven times against the now tainted House Bill 6. We appreciate Speaker Cupp’s appointment of this Select Committee to take a fresh look at the issues involved in House Bill 6.

FirstEnergy (and its former generation subsidiary) like to make money the old-fashioned way – by convincing government to give it other people’s money. Business has been good, with FirstEnergy collecting $10 billion dollars in subsidies from Ohioans since Ohio’s landmark electric deregulation law in 1999. OCC’s Subsidy Scorecard shows that, since 1999, consumers have paid Ohio electric utilities nearly $15 billion in subsidies. The Subsidy Scorecard is attached. The billion-dollar subsidy that Ohioans will pay to FirstEnergy’s former power plant subsidiary (now called Energy Harbor) is just the latest subsidy at consumer expense.

It is painful for consumers that FirstEnergy returned to seek more subsidies for these two nuclear plants given that consumers paid FirstEnergy $7 billion to transition its power plants to competition under the 1999 law that was to end subsidies. The expectation then, under Revised Code 4928.38, was that consumers would not pay power plant subsidies in the future. But as the old expression goes, the more things change, the more they remain the same.

The jewel for consumers in the 1999 electric deregulation law is power plant competition. That competition lowers electric prices and increases innovation for the benefit of Ohio consumers. Market competition, not government, should decide where capital will be deployed for future innovation in power plants.

Frankly, we think the government should abstain from interfering in the market, with prime examples of interference being the subsidizing of nuclear and coal power plants in House Bill 6. We are agnostic on fuel source, and find it particularly dismaying that Ohio is favoring dirty, uneconomic coal plants by subsidizing them at consumer expense, whether by House Bill 6 or by the past actions of the PUCO. Right now the market is favoring natural gas power plants, which is good for synergy with Ohio’s own gas resources and for low electricity prices to Ohio families and businesses. In the not too distant future, we expect the competitive market will support more renewable energy without subsidies, as its price declines and innovations occur in related technologies including battery storage.

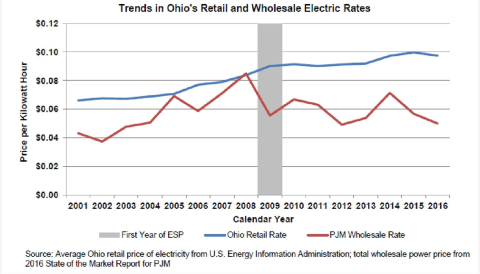

In November 2017, the Legislative Services Commission prepared the following chart regarding then House Bill 247 by Representative Romanchuk. The chart shows how the regional wholesale power plant market (red line) is working to lower electric prices for Ohioans but the Ohio retail market (blue line) is not. See how LSC shows the regional wholesale rate declining while the Ohio retail rate is rising. The LSC report is attached.

The House Bill 6 subsidies for the two former FirstEnergy nuclear plants will be $150 million per year through 2027. The bill also continued the PUCO’s bailout of the 1950s OVEC coal power plants through 2030, at public expense, to the tune of $444 million in total. The bill also subsidizes large utility-scale solar plants at about $20 million per year through December 31, 2027.

House Bill 6 also contains a so-called “decoupling” subsidy for FirstEnergy. We describe this subsidy as the other bailout. Decoupling is a ratemaking measure that decouples, or in other words separates, a utility’s revenues from its sales. Utilities would say it helps encourage them to offer energy efficiency programs by having consumers pay the utility for revenues it loses due to consumers using energy efficiency. Utilities like (or love) decoupling when their revenues are declining. That’s because, as stated, their regulator can require payments from consumers to make the utilities whole for their reduced revenues.

In justifying decoupling, utilities like to say that decoupling is balanced in that it could result in a payment to customers if revenues are higher and not just a payment to utilities if its revenues are lower. But it virtually never happens that consumers get a payment. That’s because decoupling tends to be implemented in a one-sided way to help utilities at consumer expense. For example, we don’t think it’s mere coincidence that House Bill 6 allows FirstEnergy to decouple to a reference year (2018) that had some of the highest temperatures on record (meaning also higher electric sales revenues). We’re not fans of decoupling charges but House Bill 6 has maybe the worst example of decoupling we’ve ever seen for consumers. House Bill 6 decoupling for FirstEnergy lacks any alleged redeeming quality such as being driven by support for energy efficiency programs (which are canceled in House Bill 6). Indeed, FirstEnergy’s CEO recently referred to the decoupling benefit as helping the company be “recession proof.”

The Ohio Manufacturers’ Association estimates that FirstEnergy could charge consumers a total of about $355 million over six years through 2024 (or longer until FirstEnergy files a distribution rate case) for this decoupling bailout. OMA’s analysis can be found at this link: https://ohiomfg.informz.net/ohiomfg/data/images/-%20OMA%20MEMO%20- %20HB%206%20Decoupling%20-%20FINAL%20(Aug.%2014,%202020).pdf In a repeal of House Bill 6, consumers should be freed from funding this outrageous decoupling benefit for FirstEnergy.

For these reasons and before we even get to the subject of the United States Criminal Complaint regarding House Bill 6, we support a repeal of House Bill 6. But we do also support House Bills 738 and 746 for a very prompt repeal because the bill is now tainted. FirstEnergy, a key player in the House Bill 6 process both as the former owner of the nuclear plants and as a cheerleader for the bill, is prominently referenced in the Criminal Complaints (though FirstEnergy has not been charged with a crime to date).

In supporting repeal, we are also moved by our revulsion at the effort that helped subvert the referendum process for Ohioans. That subversive effort contributed to denying Ohioans their rightful opportunity to vote on repealing House Bill 6.

Now, we know some have said that House Bill 6 saves consumers money, because it eliminates the charges for green energy mandates for renewables and energy efficiency. We get the point. But we are guided by two concerns. First, we don’t think a goal of ending the green energy mandates justifies legislation enabling the government and a big utility to interfere in the competitive market for power plant competition. Second and more importantly, this tainted bill must be repealed – and repealed promptly – out of respect for the public in whose name these processes of their government are conducted.

Further, we don’t think the case has been adequately made that the calculation of the cost savings of House Bill 6 favor its retention. The Legislative Services Commission acknowledged, in its testimony on September 10, 2020, that its July 31, 2019 fiscal analysis does not account for the savings that consumers receive from energy efficiency. And LSC then also acknowledged that its analysis does not account for the negative impact on the market resulting from power plant subsidies.

Regarding the negative impact of House Bill 6 on the market, its passage already drove out investors from two Ohio natural gas plants: the Lordstown Energy Center’s 940 MW natural gas-fired plant (in Lordstown, Ohio) and the Troy Generation Facility’s 700 MW duel fuel plant (in Luckey, Ohio). Both were cancelled in the last twelve months. Those cancellations mean a loss of $1.6 billion of investment in Ohio, as described at this link: https://www.naturalgasintel.com/another-ohio-natural-gas-fired-power-pl…- subsidies-blamed/

The case for repeal is further underscored by another event. Energy Harbor announced a stock buy-back requiring hundreds of millions of dollars despite it allegedly being a financially challenged company in need of a customer-funded bailout for nuclear power plants.

With regard to subsidies, we don’t think there should be a subsidy in a mandate today for renewable energy. Renewable energy is a good thing that should now compete in the market on its merits. We think increasingly it will succeed in the market. Also, while energy efficiency is a good thing, we prefer an approach to energy efficiency where consumers shop on their own in the market for their energy efficiency measures, without big utilities and government arranging it. We particularly object to the utilities charging consumers for profits (so-called “shared savings”) on their energy efficiency programs. The legislature has allowed utility energy efficiency profits in the 2008 energy law and the PUCO has liberally granted it (up until very recently). Examples of this imposition on consumers’ electric bills includes energy efficiency profits of $25.7 million by AEP, $7.0 million by DP&L, $10.3 million by Duke, and $12.7 million by FirstEnergy, just in 2018.

So we support House Bills 738 and 746 for an immediate repeal, especially given the background of the U.S. criminal allegations on top of the anti-consumer power plant subsidies. House Bill 6 is tainted and it should go. Even if the allegations turn out not to be crimes, the federal government’s information is revealing of undue influence by FirstEnergy and possibly one or more other utilities, and the extreme efforts to defeat the ballot initiative at the cost of Ohioans’ right to vote. There is always an opportunity later, after a repeal, for the legislature to fine-tune other issues.

But having said that, we would also favor another approach – that of immediately repealing the coal and nuclear power plant subsidies, along with simultaneously fixing certain other problems for consumers. In this regard, the repeal of the coal subsidies in Section 1 (ORC 4928.148) of House Bill 6, should also include a provision barring the PUCO from reinstating its own subsidy of the coal plants at consumer expense. Ohio should be done with making Ohioans subsidize coal power plants.

Also as stated, in Section 1 (ORC 4928.471) of House Bill 6, the decoupling provision for FirstEnergy is the other bailout. It is unfair to make Ohioans pay (in the words of FirstEnergy CEO Chuck Jones) to “recession proof” FirstEnergy. Decoupling should be repealed.

Moreover, another section of House Bill 6 should be repealed now. Section 5 of House Bill 6 is a provision requiring the Ohio Development Services Agency to seek a waiver from the federal government regarding assistance to low-income Ohioans. This waiver is to enable ODSA to increase the use of the federal Low-Income Home Energy Assistance Program (“HEAP”) funds for subsidizing weatherization. But that weatherization reduces HEAP funds available for utility bill payment assistance for at-risk Ohioans. The primary concern here should be to keep at-risk Ohioans connected to their energy utility services, which is accomplished by HEAP bill payment assistance much more so than weatherization. Please note that many of our fellow Ohioans are especially in desperate need of money during the pandemic, so bill payment assistance is especially needed now. Further, weatherizing a home (that the low-income consumer potentially does not even own) is a far greater expenditure of the HEAP subsidy per consumer than bill payment assistance. That means using HEAP funds for weatherization helps just a fraction of the consumers who can be helped using HEAP for bill payment assistance. The provision should be repealed.

Finally, there is an issue involving a “cousin” of House Bill 6. In the budget bill (H.B. 166) last year, there was a provision for Revised Code Section 4928.143(E) to benefit FirstEnergy regarding how its profits that consumers pay are calculated. That budget bill provision should also be repealed. House Bill 740 is good legislation that would solve the problem for consumers and it should be incorporated into the repeal of House Bill 6.

Thank you for your time and consideration.